Your finances matter to you, and that matters to us

Keep more of what you earn and earn more on what you save.1

We’re rewriting the rules of traditional banking, and we only win when our customers succeed. We’ve helped over 5 million members reach their goals, and we’re just getting started!

Savings are not guaranteed and depend upon various factors, including but not limited to interest rates, fees, term length, and making payments as agreed.

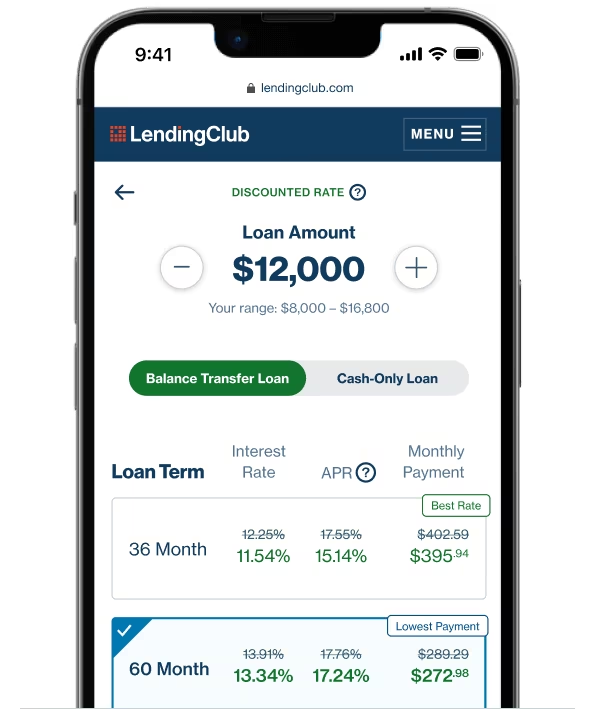

Checking a rate through us generates a soft credit inquiry on a person’s credit report, which is visible only to that person. A hard credit inquiry, which is visible to that person and others, and which may affect that person’s credit score, only appears on the person’s credit report if and when a loan is issued to the person. Credit eligibility is not guaranteed. APR and other credit terms depend upon credit score and other key financing characteristics, including but not limited to the amount financed, loan term length, and credit usage and history.

The APR discounted rate is a discount that some customers may receive for taking out a loan to pay down existing debt, which is discounted from the rate given for taking a full cash loan. Not all applicants will qualify for the discount. Any actual discount rate will be determined at the time of application. The best APR discounts are available to borrowers with excellent credit. Advertised discounted rates are subject to change without notice.

Any reviews presented are individual experiences and results may vary. Reviews are collected and authenticated by Bazaarvoice. Any average rating presented is based on these reviews. All reviews can be accessed at https://www.lendingclub.com/company/reviews.